In reporting on the fate of the bitcoin in The Washington Post, Vivek Wadhwa, a fellow at Rock Center for Corporate Governance at Stanford University and the author of R.I.P. Bitcoin, may want to add two additional factors to its possible demise.

The first is the fact that a number of unknown hackers around the world had found a way to temporary disrupt corporate communications and databases. Their target was small corporate businesses around the globe and they were demanding that the ransom be paid in bitcoins.

In one corporate case I studied while studying the impact of corporate leadership to unexpected crisis, the ransom fee was 1,000 bitcoins.

It wasn’t the small amount of the ransom, I was told. Instead, it was the fact that bitcoin’s so-called “pirates” were also making similar demands of other businesses they had hijacked. Their strategy: hack into a corporate database, interrupt the flow of their business services and then demanding immediate payment, in bitcoins, in exchange for restored service.

The hackers rightly reasoned that the automatic response would be: “OK, its a small fee, go ahead and pay it. Let’s move on.” Many did just that. In this case, the CEO divided the workforce into two groups.

Group A would dive deep into the system to find the leak, and plug it. Group B focused on making contact with every customer to explain what happened, and when they could expect to have the disruption of their online service repaired.

That is, the job of the group assigned to customer outreach was to tell each customer exactly what was going on, and what the company was doing to resolve it. It was a “we’re all in this together” personalize approach that bet on retaining customer loyalty. And it worked.

The second factor, missing from the R.I.P. bitcoin report, is the amount of electric energy it took to provide multiple layers of anonymity for bitcoin users and for each transaction they made.

The problem was not only due to “slow Internet” service, or China’s great firewall, as suggested. Experts familiar with how EACH bitcoin was created explained that a bigger problem was the fact that the *virtual* production process for each coin which required layers of privacy for each intended use, slowed down the “virtual manufacture” of bitcoins.

It was both a production problem, and a delivery problem.

Overall, the bottom line to me is this. There is a vital role for virtual currency in the global economy. Especially a virtual currency that focuses on creating a positive social benefit.

This benefit might include the trading (bartering) of virtual currency for services, where the price of those services is set by a transparent, collaborative process. The collaborators on setting each price might include those involved in selling services that make up the basis of our daily life: the butcher, the baker, the candlestick maker, and so on… in a modern context.

Finally, when used as a corporate reward system, when linked to online competitions where prizes can be redeemed through the use of ECO-coins, or e-credit cards, e-currency innovators themselves can do well, financially, by focusing on social good.

My favorite? I welcome your comments.

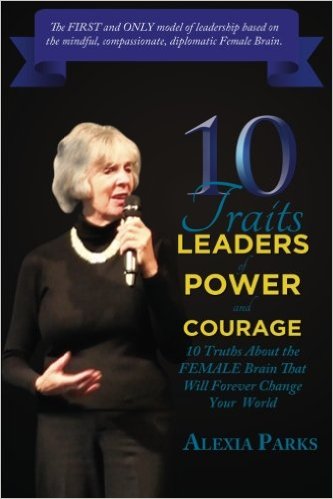

Alexia Parks is founder of 10 TRAITS Institute. An e-democracy pioneer, Newsweek called her “One of 50 people who matter most on the NET” (1995) for her launch of Votelink.com – Votelink’s co-founder was Star Wars animator Colin Cantwell.